Introduction

The UAE property market continues to evolve, with Dubai playing a pivotal role as the region’s real estate hub. Leveraging data from the Dubai Land Department (DLD), we can gain insights into past performance, current trends, and future predictions for 2024. This analysis will help investors and stakeholders navigate the dynamic real estate landscape

Historical Market Trends

1. Property Price Growth (2020-2023)

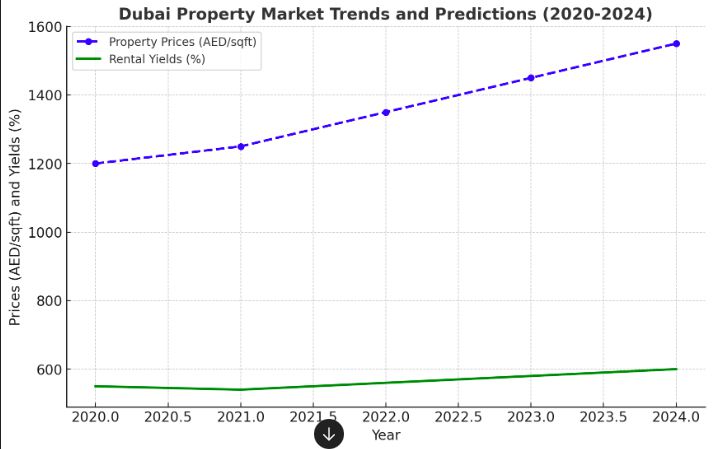

According to the DLD, Dubai’s residential property prices have steadily increased, driven by high demand in prime locations such as Dubai Marina, Downtown Dubai, and Palm Jumeirah. From 2020 to 2023:

- In 2020, the average price per square foot stood at AED 1200.

- By 2023, this figure increased to AED 1450 per square foot.

This rise reflects Dubai’s attractiveness as a global destination for expatriates, investors, and tourists alike. Infrastructure improvements and key economic events, such as the Expo 2020, have sustained this growth.

2. Rental Yields (2020-2023)

Dubai has consistently provided attractive rental yields. Based on DLD data:

- In 2020, the average rental yield was 5.5%.

- By 2023, the yield had risen to 5.8%.

These stable yields make Dubai a sought-after market for international investors looking for reliable returns, particularly as Dubai’s property prices remain competitive compared to other global cities like London and New York

Key Drivers for Market Growth

- Economic Diversification: The UAE’s efforts to diversify its economy, with a focus on technology, finance, and tourism, have created a sustainable growth environment. Real estate remains at the heart of this transformation.

- Expo 2020 Legacy: The impact of Expo 2020 continues to be felt in the real estate sector. Investment in infrastructure, new commercial zones, and an influx of expatriates contribute to the ongoing demand for properties.

- Government Reforms: The introduction of new long-term visa options, including the Golden Visa, has increased demand for residential properties, particularly from high-net-worth individuals and investors seeking residency opportunities.

Predictions for 2024

Based on current trends, property prices and rental yields are expected to continue their upward trajectory. Projections for 2024 show:

- Property Prices: The average price per square foot is expected to reach AED 1550, supported by sustained demand in prime locations and positive investor sentiment.

- Rental Yields: Rental yields are expected to average 6.0% in 2024, making Dubai’s real estate market highly attractive for investors seeking both capital appreciation and steady income.

Graph: UAE Property Market Trends and Predictions (2020-2024)

Table for Year-on-Year Comparison (2020-2024)

Test table

The table above outlines the consistent growth in property prices and rental yields in Dubai, as indicated by data from the Dubai Land Department. This steady upward trend offers a positive outlook for 2024, especially for investors looking for growth opportunities in real estate.

7DRE Real Estate - Leading Real Estate Agency of UAE

Download brochure to know more about us!

Conclusion

The UAE property market, particularly in Dubai, shows robust growth, underpinned by government reforms, economic diversification, and a global reputation as a business and tourism hub. Property prices are expected to reach AED 1550 per square foot in 2024, with rental yields climbing to 6.0%. This positive trend, coupled with regulatory incentives like the Golden Visa, makes 2024 a potentially lucrative year for real estate investments in the UAE.